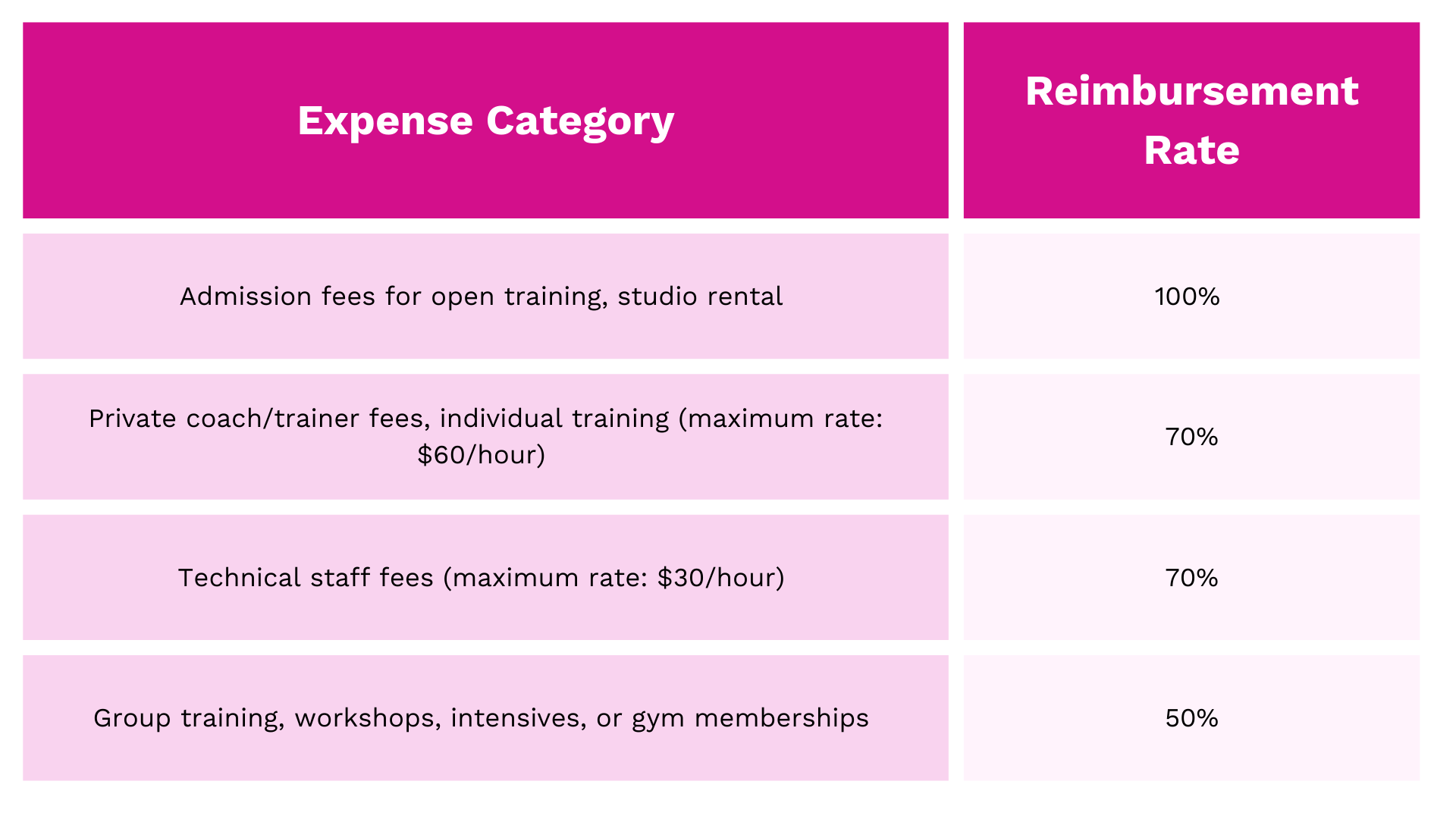

Reimbursement Assistance for Training-Related Expenses

- En Piste members in good standing* in the “Performer” or “Trainer, Coach, or Instructor” categories

- Who reside in Québec

- For expenses incurred in Québec

All three criteria must be met.

*Expenses incurred before your membership payment date are not eligible. Your membership must be valid at the time the expense is incurred. Example: If your expense took place in February but you paid your membership in March, the expense is not eligible.

Up to $800 (taxes included) per person per fiscal year (January 1 to December 31).

Reimbursements will be processed on a first-come, first-served basis until the budget is depleted.

The calendar is now quarterly:

1. January to March (closed: as the budget for the first quarter has been exhausted, it will no longer be possible to claim reimbursement for expenses incurred between January and March).

2. April to June (closed)

3. July to September (closed)

4. October to December (closed)

Details of second-quarter reimbursement will be announced shortly.

All expenses must be incurred in Québec and related to training.

- Expenses incurred before the En Piste membership is paid

(e.g., you become a member in November 2025, an expense from October 2025 is not eligible)

- Online training

- Expenses incurred outside Québec

- Expenses related to act or show creation (e.g., hiring an artistic director to develop an act)

- Equipment purchases

- Fees paid for En Piste training activities (this includes both group and individualized training)

- Expenses covered by another grant or subsidy (e.g., Services Québec, CALQ, CAM, or other funders)

Given the very high number of applications and the administrative work involved in offering the service, any incomplete application will be rejected.

Please include your first and last name in the title of each document.

1. Proof of residence:

If this is your first application of the year, you must submit a recent proof, in PDF or JPG format, from one of the following choices:

- Bill from an internet, cable, or telephone service provider

- Utility bill (electricity, heating)

- Valid Québec driver’s license

- Municipal or school tax bill

- Home insurance document

2. Invoice:

- Must be in PDF format

- 1 expense = 1 invoice = 1 document. Do not merge several invoices in one document.

- The invoice must include:

- Name: must match the applicant (no invoices in a company’s name).

- Taxes: if the provider charges GST/QST, tax numbers must be indicated.

- Service: must clearly indicate the service provided (rental, coaching, membership, etc.).

3. Proof of Payment:

- Invoices must be accompanied by proof of payment showing the payer’s and provider’s names. Do not merge documents.

- Exception: if the invoice is marked “paid,” no additional proof is needed.

- Examples of proof of payment: Screenshot of Interac transfer, Bank statement (highlight the transaction).

INCOMPLETE OR INCORRECTLY FILLED APPLICATIONS WILL BE REJECTED.

Please review the information above before submitting your application.

Contact: [email protected]